A new year means it’s time for another update on our “churchfunding” house loan adventure! How is it working for us by now? In short, we are making monthly repayments as planned and remain deeply grateful for all who helped us buy this house.

(Here is the post that officially launched this churchfunding adventure. We purchased our Atlanta house on March 25, 2016, paying the seller in full immediately, thanks to loans and gifts from nearly 90 individuals or families.)

At the beginning of 2019, we owed $41,687.50 in house loans.1 By the end of 2019, we owed only $35,062.50.

Here is how that $6,625 difference breaks down. We repaid $5,750 in loans in 2019 at the planned rate of $500 per month. Why is this total not $6000? Several lenders, when offered their promised repayment, declined the 10% interest we had promised. Also, two lenders forgave a total of $750 in principal. In total, we were forgiven $875 in principal and interest in 2019. We are thankful for this generosity! $875 (forgiven) plus $5,750 (paid) equals $6,625. This means our house debt declined by $625 more than we expected in 2019.

Since we began repayments in April of 2016, a total of 28 lenders have receive partial or total repayment. Another 33 lenders are still awaiting their first repayment.

When can the remaining lenders expect repayment? At the promised $500 per month, we should have all remaining lenders repaid within six years—by about October of 2025. As promised, we are using a random number generator (and prayer!) to select who is repaid each month. If you have a financial squeeze, however, feel free to let us know and we will consider prioritizing your repayment as possible.

Cash Flow and House Happenings

Our cash flow is still tight, but slightly better than a year ago, thank God. I continue to work three days a week for Choice Books, but my number of piano students grew in 2019. I temporarily reached 30 students, finishing the year with about 27—about nine more than a year ago! In addition, as was true a year ago, I have more students who hope to resume or begin lessons in January. By now my biggest growth obstacle is time—do I really want to begin teaching Friday evenings or Saturdays?

Our largest expense in 2019 was finally getting three big trees removed from our backyard. What a relief!

One tree was dead, two were unhealthy, and all three were a hazard not only to our house, but even more to our neighbor’s house. Several initial quotes back in 2016 were for $5000 and $6000, so we cut vines off around the base of the trees, waited for the vines to die and drop, and prayed whenever it got windy. A shout-out to Boutte Tree, who gave us a fair deal ($3,240) and demonstrated a lot of expertise getting the job done!

Other “extra” expenses for 2019 included:

- A 1-1/2 year Greek class I finished in July (highly recommended—see here)

- Physical therapy for my shoulder (covered under Samaritan Ministries–mention us if you sign up!)

- Continued cello and violin lessons for our two oldest daughters (see videos below)

House projects in 2019 were very minor, though I did do some flood-proofing in the basement and also began soundproofing the door between my piano studio and Zonya’s kitchen—a much-needed effort!

House prices in our neighborhood continue to rise. More vacant homes are being refurbished and inhabited, including on our own street. The real estate website Zillow, which estimated our house value at $81,000 back in March 2016 just before we bought it for $65,000, now estimates our house is worth about $215,000.

Church and Witness

As I shared last year, we are no longer actively pursuing a formal church plant in our neighborhood. We have been attending Cellebration Fellowship in Clarkston, GA, for over a year now. The people there have been welcoming, and we have fit in as we are able. I’m recruited to play piano most Sundays and I preached one sermon this year; the girls enjoy Sunday school; and we’ve all been blessed by the various personal expressions of friendship we’ve received. Loneliness is still real for most of us, however, and Zonya and I are experiencing the common midlife awareness that life has not turned out as we once dreamed.

Despite our questions, “the house that God bought” saw ministry opportunities over the past year, such as:

- Many piano students and a “Living Room Recital”

- A neighbor girl who often comes looking for our daughters

- A hungry man who sometimes knocks on our door

- Several new neighbors glad for friendship and support

- Our own children, whom Zonya faithfully homeschools

- A couple who stays overnight when they come to Atlanta for medical appointments

- My blog writing efforts

- Praying for God to put his angels around our neighborhood each night

- International students who came for a vegetarian Thanksgiving

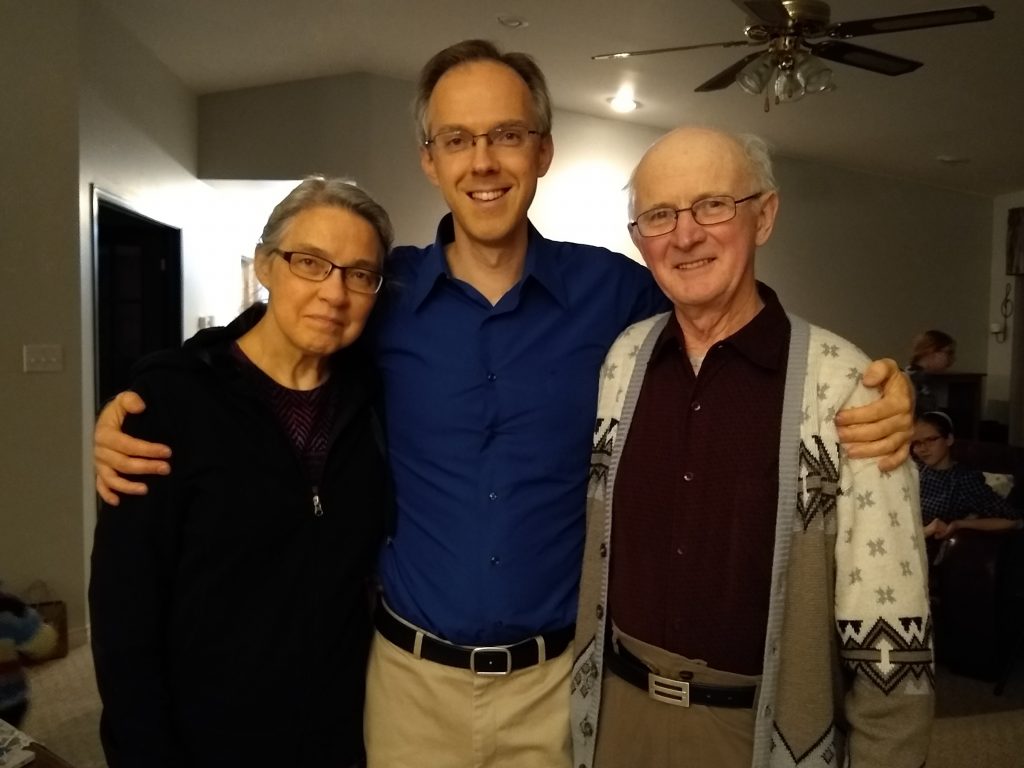

Dad’s Health

At risk of turning this post into a virtual Christmas letter, I’ll mention one more big change in our family in 2019: This fall we learned that my dad’s cancer has returned, with a tumor in his chest (non-Hodgkin’s lymphoma). In early December we traveled to Canada, where we helped Dad and Mom and my siblings weigh this sorrow and make decisions about treatment. Dad and Mom have decided not to pursue any chemo, but simply to trust to God the number of his remaining days. Doctors predict less than six months; God knows.

It was a special privilege to spend time with Dad during this visit, joining him and Mom at the medical clinic when the results of his latest biopsy were shared, hearing stories from his boyhood days, and praying together as a family. Thanks to each of you who are praying for Dad!

We remain deeply grateful for all our churchfunding supporters. We welcome your prayers as we seek God’s light for the coming year. We want to faithfully steward this house for Jesus in 2020 and be salt and light in our community.

For Christ and his Church,

Dwight Gingrich

- Accountant readers might notice that figure is $250 less than what I reported a year ago. That is because on December 31, 2018—after I published my 2018 year-end report—one lender changed his $250 loan into a gift. (Thanks again!) ↩